If you are like most accounts payable managers, you are constantly looking for ways to streamline and automate your workflow process. The more time you can save on tasks such as invoice processing and vendor management, the more time you can spend on higher-value activities. And one of the best ways to automate your accounts payable process is to implement an automated accounts payable solution. But before you read further about the solutions to setting up an automated accounts payable workflow, let us dig further into AP (Accounts Payable) processes steps and the flow-chart.

The Basics of Accounts Payable Workflow Process

Although AP workflow steps and process can vary with the type of transaction or the department in the company, there are some basic steps that will be found common across different AP workflow processes.

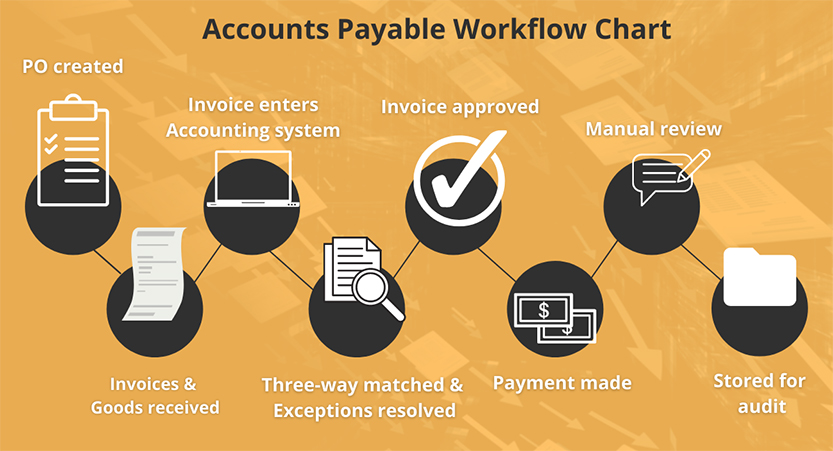

Below is the flowchart of the basic steps involved in the accounts payable process workflow.

Considering the above illustration, the workflow kicks off with initiating a purchase. The purchasing department of an organization sends a PO to a vendor with information like requested merchandise, quantity, and price. Business then receives the goods and invoices which are entered into an accounting system and three-way matched with a receipt report and PO. There might be some discrepancies or exceptions which must be dealt with before approval. Post approvals the transaction is reviewed and then stored in an audit format.

The Big Question: Manual Vs. Automated Accounts Payable Workflow

There is no question when it comes to choosing a winner between the manual and automated Accounts Payable workflow processes. Manual AP processes require AP professionals to manage tasks such as filing paper documents, and inputting data manually. There is no ability for error correction or monitoring of matching numbers line-byline, making this an outdated method prone towards failure.

On the other hand, automated AP workflows can take human errors out of the equation. Automated AP workflow process takes complete control of your AP function and cuts out anything manual from it.

According to IOFM, 71% of businesses planned to automate their accounts payable workflows further in 2020, and they continue to do so. To understand the motivation behind this transformation, we identified the top 5 reasons for you to automate your accounts payable workflows.

1. Helps detect and mitigate Accounts Payable Fraud: Automated Accounts Payable Workflow processes use the power of automation that helps AP teams to detect issues in invoices and payments. Through automated processes, matching invoices to payments and detecting things like duplicate payments and multiple payees for a single vendor becomes an integral part of the setup.

2. On-time payments, avail early payment discounts and cut off late payment dues: Compared to the manual processes which are vulnerable to mistakes, the automated accounts payable system brings efficiency and productivity. Automated workflows keep the status of payments and invoices up to date, which helps in keeping a check on timely payments and sometimes early payments to avail of early payment discounts and hence avoiding any bottlenecks that are usually faced in manual AP processes.

3. Offers a centralized AP Process: With AP automation, accounting teams no longer need to spend time searching for paperwork pertaining to individual orders. This centralized database means that all invoices and purchase order information is at their fingertips ensuring more efficient workflows which saves you money. The centralized system acts as a common dashboard that makes it easy for anyone from the AP team to keep track of the statuses of invoices at any given time.

4. Say goodbye to manual data entry processes: There is no universal format for creating invoices. Every organization follows their own format and structure when it comes to invoices. This is why extracting data from invoices is a very tedious and laborious task. Manual extraction of data from invoices is also prone to frequent errors. Intelligent automation of invoice processing workflows effortlessly extracts data and ingests it into your customized format. This eliminates the possibility of human error and saves your AP team a lot of time. This is que for you to leverage AP automation for a more efficient and productive AP function.

5. Be ready for audit: An automated solution can neatly arrange all invoice documents in a shared drive arranged by vendor name and date of receipt and that helps you be ready for audit in a jiffy.

6. Boosts your business profitability: Having an automated Accounts Payable workflow creates a huge scope for your business to increase profitability. The automated system eliminates bottlenecks of delayed payments or heavily incurred late payment charges. This improves your relationship with the vendors and builds mutual trust. On-time payments result in potential discounts on future orders, which creates an opportunity to save money for your business. Automated workflows and system also help you with AP fraud that is briefly mentioned above. All of this and much more help you focus on improving the core business objectives and boosting profitability for your business.

How Kanverse.ai can help you automate your Accounts Payable Workflow?

Imagine a world where you could see every invoice your company issued, know how much money is owed to each one and get alerts when someone doesn't make their payment. That’s what an automated accounts payable workflow can bring to you.

The benefits don’t stop there though; with real-time data also comes insight into which employees are most productive (and least prolific) so that tiny imperfections in the process can be quickly identified before they become larger problems for your business.

From lack of visibility to complete control is the one thing that you and your team of AP staff can achieve with automation. That’s the power of having an Accounts Payable automation software.

AP automation software like Kanverse APIA (AP Invoice Automation) is built to do the heavy lifting across your AP cost centers while your staff can focus on productive and business-critical activities.

Automated invoice processing workflows brings efficiency

The shift from manual to automated invoice processing workflows brings efficiency, accuracy, fraud detection, timely payments, centralized access, data extraction, audit readiness, profitability boost, and enhanced insights. Kanverse.ai's AP automation software streamlines this transition effectively.

About Kanverse.ai

Kanverse Accounts Payable Invoice Automation digitizes document processing for enterprises from ingestion, classification, extraction, validation to filing. Extract data from a wide gamut of documents with up to 99.5% accuracy using its multi-stage AI engine. Say goodbye to manual entry, reduce cycle time to seconds, optimize cost by up to 80%, minimize human error, and turbocharge productivity of your team.

Schedule a demo with us today to find out more.

Conclusion

To build an efficient workflow, you need to adapt to certain processes that impact business growth and profits. Accounts Payable workflow automation is the key for the AP function to streamline and strengthen the function. It allows businesses to easily track invoices, payments, approvals, etc. from a centralized system. This level of control is something that manual workflows cannot offer

About the Author

Himanshu Naidu, Product Marketing, Kanverse.ai